Ensuring proper documentation, including pay stubs, is essential for individuals and organizations to comply with IRS regulations and other legal obligations.Ī pay stub generator is a convenient way to make paycheck stubs online using our pay stub generator tools. It's important to note that specific requirements for pay stubs may vary depending on the jurisdiction and the purpose for which they are requested. Legal Proceedings: Pay stubs may be required in legal proceedings, such as divorce cases, child support hearings, or wage dispute lawsuits, as they serve as evidence of income and employment. Accurate pay stubs ensure proper tax reporting and compliance. Landlords and Rental Agencies: Pay stubs are often requested by landlords or rental agencies to assess a tenant's ability to pay rent on time and verify their income when considering rental applications.Īccountants and Tax Preparers: Pay stubs provide essential information to accountants and tax preparers for calculating income tax liabilities, deductions, and credits for individuals and businesses. Pay stubs verify the applicant's income and employment stability. Pay stubs provide crucial documentation for tax purposes and ensure compliance with tax regulations.įinancial Institutions: Banks, credit unions, and lending institutions require pay stubs when individuals apply for loans, mortgages, or other forms of credit.

#Intime staffing check stubs verification#

Government Authorities, including the IRS: Government agencies, including the Internal Revenue Service (IRS), may request pay stubs for tax audits, income verification for public assistance programs, or employment-related investigations. Pay stubs help employers maintain accurate records of employee compensation and act as evidence of payment during disputes or audits. They play a significant role in personal financial management, budgeting, tax filing, loan applications, rental agreements, and as proof of income.Įmployers: Employers generate and provide pay stubs to employees as part of the payroll process. Here are some examples of who may need a pay stub:Įmployees: Pay stubs serve as crucial records for employees to track their earnings, deductions, and other financial details. By providing detailed information about income and deductions, pay stubs play a crucial role in assisting employees in budgeting, tax planning, and monitoring their financial well-being.Ī paystub is a document that finds relevance for various individuals and entities. They enable employees to gain a comprehensive understanding of their earnings, deductions, and overall financial situation. These documents hold significant importance for effective financial management and maintaining accurate records.

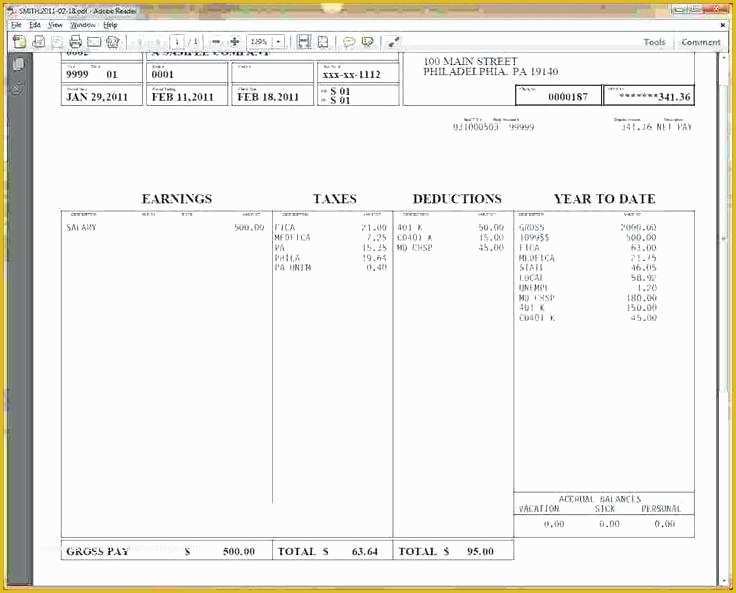

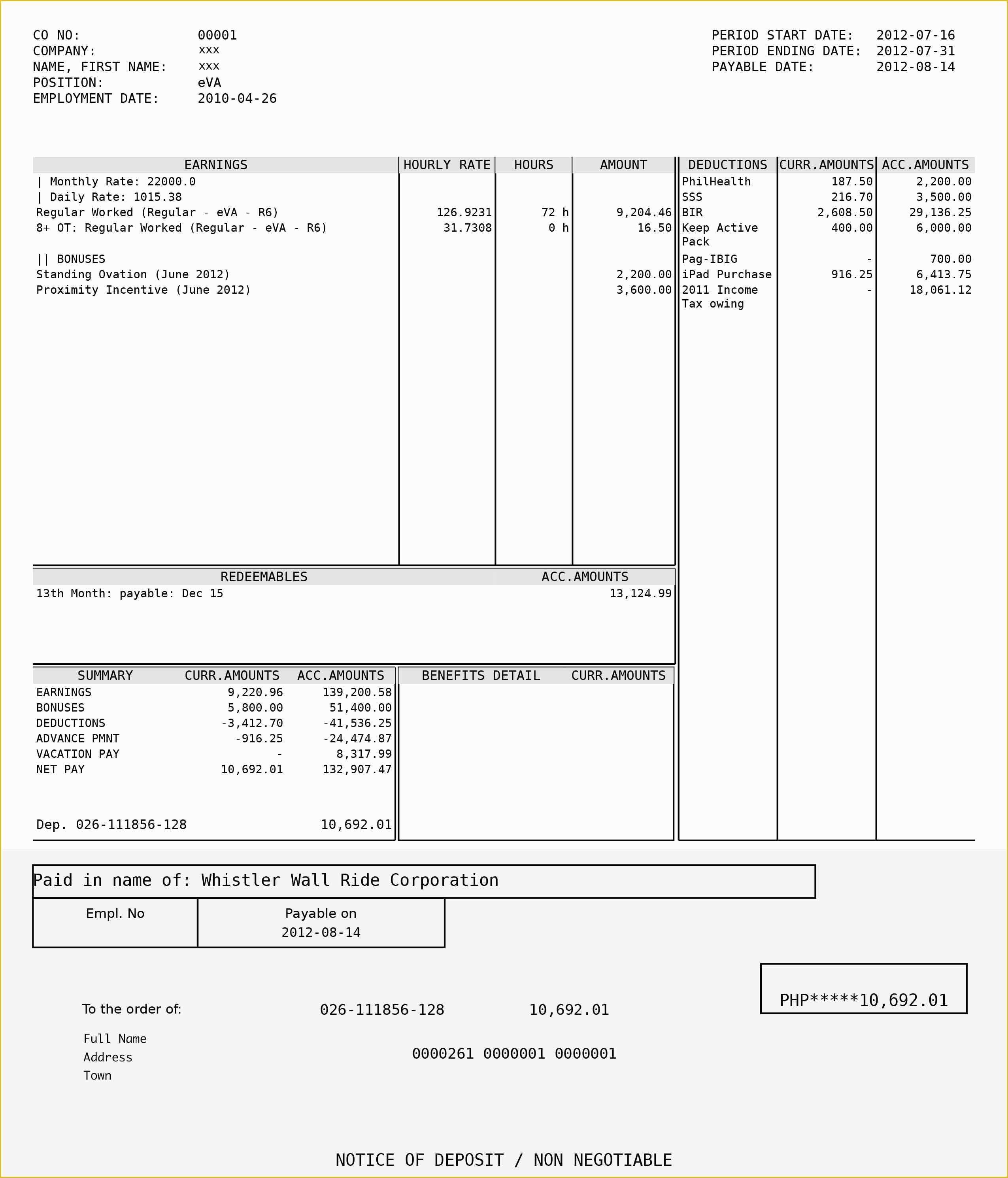

Pay stubs can be issued to employees in either physical or electronic formats, depending on the policies of the employer and the preferences of the employee. This feature enables employees to track their overall income and deductions over time. Year-to-Date (YTD) Information: Pay stubs often include a summary of the employee's earnings and deductions for the current year up to the present pay period.

It is the actual amount that will be received in the paycheck or through direct deposit. Net Pay: The net pay, also known as take-home pay, represents the amount the employee receives after all deductions and taxes have been subtracted from the gross earnings. Other deductions like union dues or wage garnishments may also be specified. Common deductions comprise contributions to retirement plans (e.g., 401(k)), health insurance premiums, life insurance premiums, and other benefits. Additional tax-related information, such as Social Security and Medicare contributions, may also be included.ĭeductions: This segment lists the amounts subtracted from the employee's gross earnings as deductions. Taxes: Pay stubs provide a breakdown of taxes withheld from the employee's earnings, such as federal income tax, state income tax, and local taxes. It may specify earnings by hourly rate, salary, or other applicable payment methods. Pay stubs serve as valuable records of an employee's compensation and find utility in verifying income, calculating taxes, and monitoring deductions.Ī typical pay stub includes the following essential information:Įmployee Information: It consists of the employee's name, address, and identification number.Įmployer Information: This section includes the employer or company's name, address, and contact details.Įarnings: The paystub itemizes the employee's gross earnings for the given pay period, representing the total amount earned before any deductions. It is commonly issued by employers along with paychecks or direct deposit notifications. A pay stub, also referred to as a paycheck stub or pay advice, is a crucial document that provides comprehensive details about an employee's earnings and deductions for a specific pay period.

0 kommentar(er)

0 kommentar(er)